Wheat (WHEAT)

Wheat Price in the Financial Mark

Wheat is one of the world's most essential soft commodities, deeply ingrained in the global agricultural economy. Its price, which fluctuates due to various factors, plays a crucial role in the financial markets. Wheat prices are determined largely by futures contracts on exchanges like the Chicago Board of Trade (CBOT), with wheat futures contracts for delivery months such as March or July frequently cited as benchmarks for the market. These contracts are seen as an important barometer for global wheat price trends.

In the United States, the Chicago Wheat Futures market is where much of the trading activity occurs, with prices quoted in USD per bushel. Wheat prices can vary significantly from day to day due to changes in both supply and demand factors, as well as broader economic conditions. Investors, traders, and farmers closely monitor these markets, relying on Wheat charts, and utilizing tools such as a Wheat price calculator to predict market movements.

Overview of Current Wheat Price Trends

As of late 2024, wheat prices have shown notable volatility, driven by several key factors. The most recent data shows that wheat futures are experiencing a decline in value, with prices hovering around $550 per bushel. This marks a decline of nearly 4.68% from the previous year, although prices have been subject to fluctuations in the short term. Concerns over supply shortages, including poor crop yields in key producing regions such as the U.S. and the Black Sea area influenced the price increase from September to October.

While wheat prices had experienced a surge earlier in the year, due to adverse weather and droughts, they stabilized as rains in key regions like the U.S. and Argentina helped to ease concerns about supply. The ongoing geopolitical situation, particularly with regards to Russia's role in the wheat market, also impacts prices, making them susceptible to unexpected rises and drops.

Current Wheat Price Market Trends

The wheat market today is shaped by several current trends. One significant trend is the global supply chain disruption caused by climate change and geopolitical instability. For example, wheat prices have been impacted by adverse weather conditions such as droughts in major production areas, particularly the U.S. and Russia. As a result, there have been fluctuations in the amount of wheat available, which is reflected in the prices seen in the futures markets.

Additionally, the strength of the U.S. dollar plays a key role in wheat price trends. A stronger dollar can make U.S. wheat more expensive for foreign buyers, decreasing demand and potentially leading to price declines. In contrast, a weaker dollar can make U.S. wheat more attractive on the global market, which may drive up prices. The fluctuation in exchange rates, along with the ongoing trade tensions between major wheat-exporting countries, will continue to play a significant role in shaping the market for wheat.

Factors That Affect Wheat Price and the Wheat Market

There are several factors that contribute to the price action of wheat and the broader wheat market. Among the most important are:

- Weather Conditions : As a crop heavily influenced by weather patterns, wheat prices are highly sensitive to climatic conditions. Droughts, excessive rainfall, and temperatures that deviate from the norm can all have a profound impact on crop yields, which in turn affects wheat prices. Recent challenges, such as the ongoing droughts in parts of the U.S. and Argentina, have caused concerns about lower yields.

- Global Supply and Demand : Supply disruptions, such as poor harvests or logistical bottlenecks, can lead to spikes in wheat prices. Conversely, when supply is abundant, prices may fall. Moreover, the global demand for wheat, particularly from emerging markets, directly impacts prices. As countries with growing populations and urbanization demand more wheat for food production, prices tend to rise.

- Government Policies and Subsidies : In major wheat-producing countries, government policies, including subsidies and tariffs, can have a substantial effect on wheat prices. These policies can either incentivize production or restrict exports, thus altering the global supply and price equilibrium.

- Geopolitical Events : Political instability, particularly in regions like the Black Sea and the Middle East, can cause major price swings in wheat. The Russian invasion of Ukraine, for instance, has had significant impacts on global wheat supply and prices, as both countries are major exporters.

- Currency Fluctuations : As mentioned, the strength of the U.S. dollar can affect wheat prices. A stronger dollar can make wheat more expensive for foreign buyers, which can lead to decreased demand and falling prices. Currency fluctuations also affect wheat export prices, creating instability in the global market.

Other Related Commodities Affected by Wheat Price Action

The price of wheat does not exist in a vacuum—many other agricultural and commodity markets are closely linked to wheat prices. For instance, corn, barley, and other grains often exhibit similar price patterns due to shared environmental and economic factors. When wheat prices rise, other grain prices may also increase due to competition for land and resources.

Similarly, livestock prices can be affected by wheat price movements. As wheat is a key component of animal feed, higher wheat prices can lead to increased costs for raising livestock, which may drive up the price of meats such as beef, pork, and chicken. For example, if the price of wheat rises, the cost of feeding livestock also rises, which can lead to higher meat prices as producers pass on those costs to consumers.

Finally, energy prices can be influenced by wheat price movements as well. Wheat is often used as a biofuel, particularly in the production of ethanol, which links the wheat market to the energy market. Price fluctuations in wheat can, therefore, have a cascading effect on energy prices.

Wheat Trading Strategy and Price Prediction

Traders looking to enter the wheat market must carefully develop a Wheat trading strategy that accounts for the unique volatility in the agricultural commodities sector. Common strategies include long or short positions in wheat futures contracts, depending on whether a trader expects prices to rise or fall. Many use technical analysis, analyzing Wheat charts and patterns, alongside fundamental analysis to predict future price movements. For those looking to forecast wheat price trends, the Wheat price prediction can be an essential tool in shaping trading decisions.

Conclusion

Wheat is a critical commodity in the global market, influenced by a range of factors from weather conditions to geopolitical events. The fluctuating nature of wheat prices means that both farmers and traders must be astute in monitoring market trends and adapting their strategies accordingly. Understanding the intricacies of wheat price trends, the factors affecting them, and how they relate to other commodities is essential for anyone involved in wheat trading. Using tools such as the Wheat price calculator can help make more informed decisions when choosing to buy or sell wheat.

For anyone looking to engage with the wheat market, staying informed about the factors that affect wheat prices is crucial. By carefully analyzing the market, using up-to-date Wheat price predictions, and considering related commodities, traders can position themselves to make the best decisions in the ever-changing world of agricultural commodities.

| Swap long | -0.3231 points |

|---|---|

| Swap short | 0.0614 points |

| Spread min | 1.07 |

| Spread avg | 2.01 |

| Min contract size | 0.1 |

| Min step size | 0.1 |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

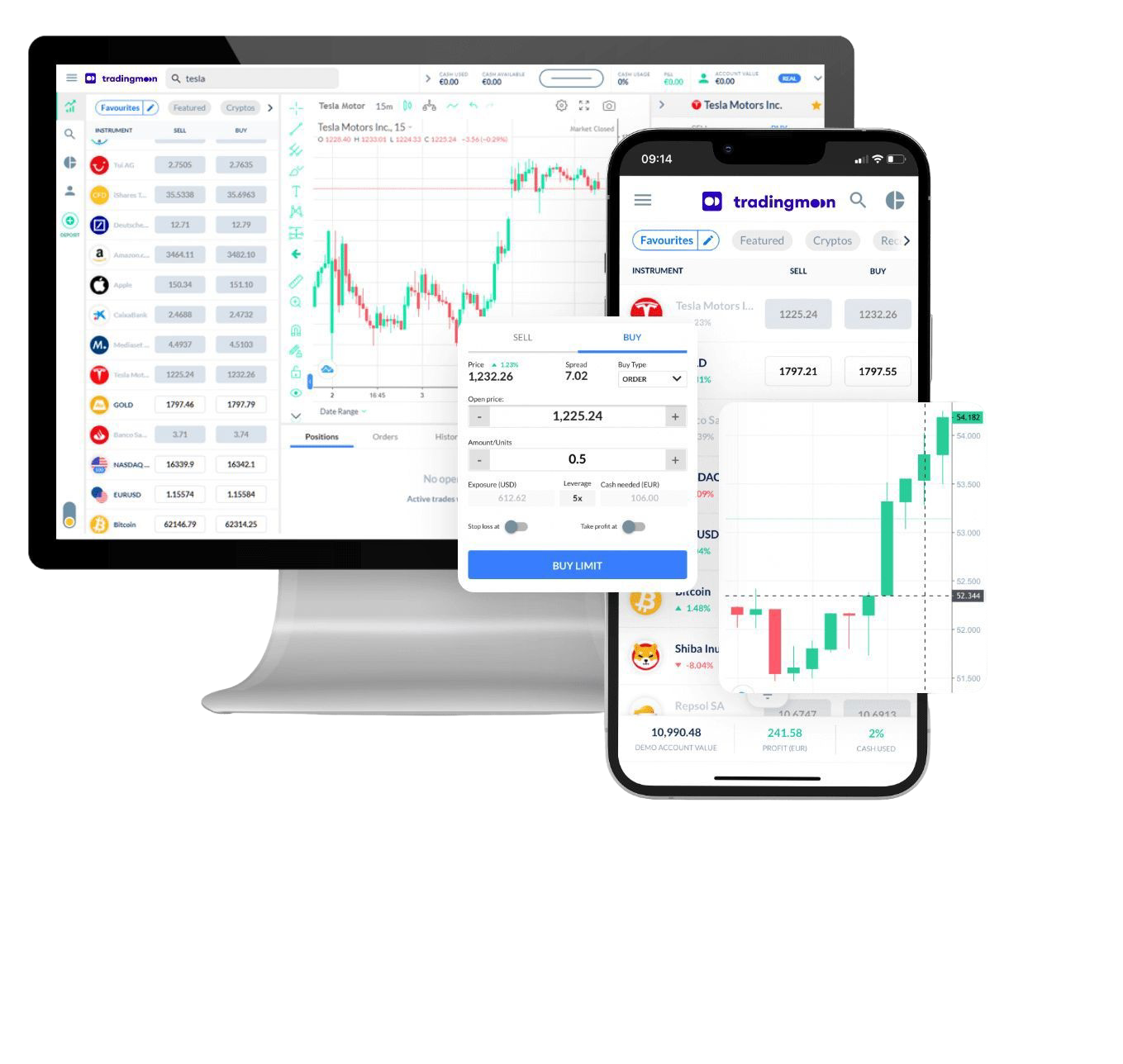

Trade Wheat with TradingMoon

Take a view on the commodity sector! Diversify with a single position.

- Trade 24/5

- Tight spreads

- Average Execution at 5ms

- Easy to use platform

FAQs

What affects Wheat prices?

+ -

Wheat prices are affected by a number of factors, including global supply and demand, weather conditions, government policies, trade agreements, and geopolitical events. For example, the severe drought of 2012-2013 in the United States caused wheat prices to skyrocket due to decreased yields. That year marked one of the worst harvests in U.S. history, with prices rising over 60% in some areas.

On the other hand, a bumper crop in Russia in 2020 caused wheat prices to fall due to increased global supply. The United Kingdom’s Brexit vote also had an impact on wheat prices, as it created uncertainty among traders and led to increased demand for safe-haven assets such as wheat. It is important to stay informed of such news and events as they can have a substantial impact on wheat prices, so it pays to be a savvy trader!

How to trade Wheat CFD?

+ -

Wheat CFDs are an exciting way of profiting from the fluctuating prices of wheat. However, as with any type of trading, there are certain things to take note of before entering into a trade. Here are some important considerations when trading Wheat CFDs:

1. Monitor news and supply/demand levels – While wheat is a relatively stable commodity, its price can be impacted by news events and supply/demand levels. It is important to closely monitor these factors in order to make informed trading decisions.

2. Choose a reputable broker – Choosing a broker like TradingMoon to trading Wheat CFDs. Ensure that your chosen broker offers competitive spreads, low commissions and reliable executions.

3. Utilize risk management strategies – Wheat CFDs can be volatile and risky, so it is important to use risk management strategies such as stopping losses and limits in order to protect your capital.

4. Take advantage of leverage – Leverage can help traders increase their exposure to the markets with minimal amounts of capital. However, it is important to use leverage responsibly and ensure that you understand the risks associated with trading on margin.

By understanding the different aspects of Wheat CFD trading and utilizing the right strategies, traders could increase their chances of success when investing in this asset class.

What are the other options for trading Wheat?

+ -

Apart from trading Wheat, there are other options to consider. For instance, multinational companies that highly depend on Wheat can be an interesting option for traders. These multinational companies may include agricultural commodity producers and processors such as food and beverage giants like General Mills and Kraft Heinz.

Trading in these products enables traders to gain exposure to the Wheat market, as well as leverage the potential of price movements in these companies. Trading in these multinational companies also provides a great opportunity for traders to research the underlying fundamentals and make informed decisions when trading. Additionally, traders can diversify their portfolios by trading in other agricultural commodities such as Corn, Soybeans, Cotton, and Rice.

Why Trade Wheat

Make the most of price fluctuations - no matter what direction the price swings and without the restrictions that come with owning the underlying asset.

CFD

Actual Commodities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Trade on volatility

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels