Cotton (COTTON)

Cotton Price Financial Market

The cotton market is a significant player in the broader soft commodities sector. As with other commodities, cotton prices are influenced by global economic factors, including demand and supply, weather conditions, and financial market trends. The global cotton market is mainly driven by the futures market, where traders speculate on cotton price movements. Cotton futures are typically traded on exchanges such as the Intercontinental Exchange (ICE), and these contracts represent a commitment to buy or sell cotton at a predetermined price at a future date. This mechanism ensures liquidity and provides price discovery, which is crucial for traders, manufacturers, and farmers alike. Market participants include agricultural producers, commodity traders, and speculators, all of whom influence cotton price fluctuations.

The financial market has seen increasing interest in cotton as a commodity investment, particularly due to its connection to other sectors like apparel manufacturing and the wider agricultural market. For investors looking to diversify their portfolios, understanding the cotton market’s volatility, price prediction models, and using a Cotton price calculator are important tools for making informed decisions.

Overview of Current Cotton Price Trends

Cotton prices have experienced fluctuations driven by several factors such as changing weather patterns, geopolitical events, and global demand. For instance, 2024 has seen cotton prices oscillating between support and resistance levels around $83 to $89 per pound. This period of price movement provides valuable insights for investors who are considering whether to buy Cotton or sell Cotton. Speculative actions in the market, such as the buying of cotton futures in anticipation of price hikes, have contributed to the volatility. Prices have shown short-term upward trends, driven by increasing demand from countries like China, which is the world’s largest importer of cotton.

A Cotton chart offers a visual representation of these fluctuations, which is an essential tool for market analysis. By reviewing historical data, one can identify recurring trends and develop strategies for future price movements.

Current Cotton Price Market Trends

Currently, the cotton market is in a phase where short-term signals show a buying opportunity, with cotton prices showing a moderate but steady upward trend. While there is some risk involved, as indicated by small daily volatility percentages, the general market sentiment leans toward optimism, especially with increasing cotton consumption in emerging markets.

One of the most significant aspects of the cotton market today is its correlation with the broader agricultural and textile markets. As demand for cotton products rises in countries such as India and China, cotton prices tend to rise, although they remain susceptible to fluctuations due to external factors such as global weather patterns (droughts, floods) and supply chain disruptions. Prices tend to spike when weather events negatively affect cotton crop yields, particularly in major producing countries like the United States, India, and China.

Moreover, shifts in the textile industry, including the transition towards sustainable and organic cotton, can influence market trends. This push for sustainability has led to a demand for cotton varieties with improved environmental footprints, which could affect cotton pricing in the long term.

Factors That Affect Cotton Price and the Cotton Market

Several factors influence cotton prices, ranging from global supply and demand dynamics to specific regional conditions.

- Weather Conditions: Cotton crops are extremely sensitive to climate changes. A drought in a major cotton-producing region, like Texas or India, can significantly reduce yield and push prices higher due to limited supply.

- Global Demand: Cotton is the primary raw material for the textile industry. Therefore, any increase in the global demand for clothing, particularly in developing countries, can drive prices up. On the other hand, economic slowdowns or changes in consumer behavior, such as the shift toward synthetic fabrics, can reduce demand and lower prices.

- Government Policies and Subsidies: In major cotton-producing countries, government policies, such as price supports and subsidies, can influence supply and ultimately the price of cotton. These policies can be a double-edged sword, as they may stabilize prices in the short term but can also lead to oversupply or price distortions over time.

- Currency Movements: As cotton is traded globally, currency fluctuations, especially between the U.S. dollar and other currencies like the Chinese yuan, can impact the market. A stronger dollar typically makes U.S. cotton more expensive for international buyers, which may reduce exports and affect prices.

Other Related Commodities That Are Affected by the Price Action of Cotton

Cotton is part of a broader category of agricultural commodities, and its price action can influence and be influenced by other commodities.

- Textile and Apparel Markets: The most direct impact is on the textile and apparel industries, which rely heavily on cotton. Fluctuations in cotton prices can lead to higher or lower costs for manufacturers and ultimately affect retail prices for clothing.

- Wheat and Soybeans: These crops are often grown in the same regions as cotton, and weather conditions that impact cotton production may also affect other agricultural commodities like wheat and soybeans. Additionally, shifts in farming practices due to market conditions can lead to changes in planting decisions, influencing the supply and price of cotton and its agricultural counterparts.

- Natural Fibers: The price of cotton can also influence other natural fibers like wool and flax. When cotton prices rise significantly, manufacturers may look for alternatives, which can push up demand and prices for other fibers.

Conclusion

Cotton remains one of the most important agricultural commodities globally. Prices are impacted by a complex range of factors, including weather, market demand, governmental policies, and the financial market dynamics of cotton futures trading. As we look ahead, monitoring these factors using tools like a Cotton trading strategy or a Cotton price prediction model will be essential for market participants. By understanding the forces shaping cotton prices and its interconnection with related markets, investors and traders can better navigate the ups and downs of the cotton market.

For those looking to dive deeper into cotton price analysis, a Cotton price calculator can provide useful real-time information for informed decision-making. Whether you're a manufacturer, trader, or farmer, staying on top of these trends is crucial for success in the ever-evolving cotton market.

| Swap long | -0.0304 points |

|---|---|

| Swap short | 0.0097 points |

| Spread min | 0.22 |

| Spread avg | 0.23 |

| Min contract size | 0.01 |

| Min step size | 0.01 |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

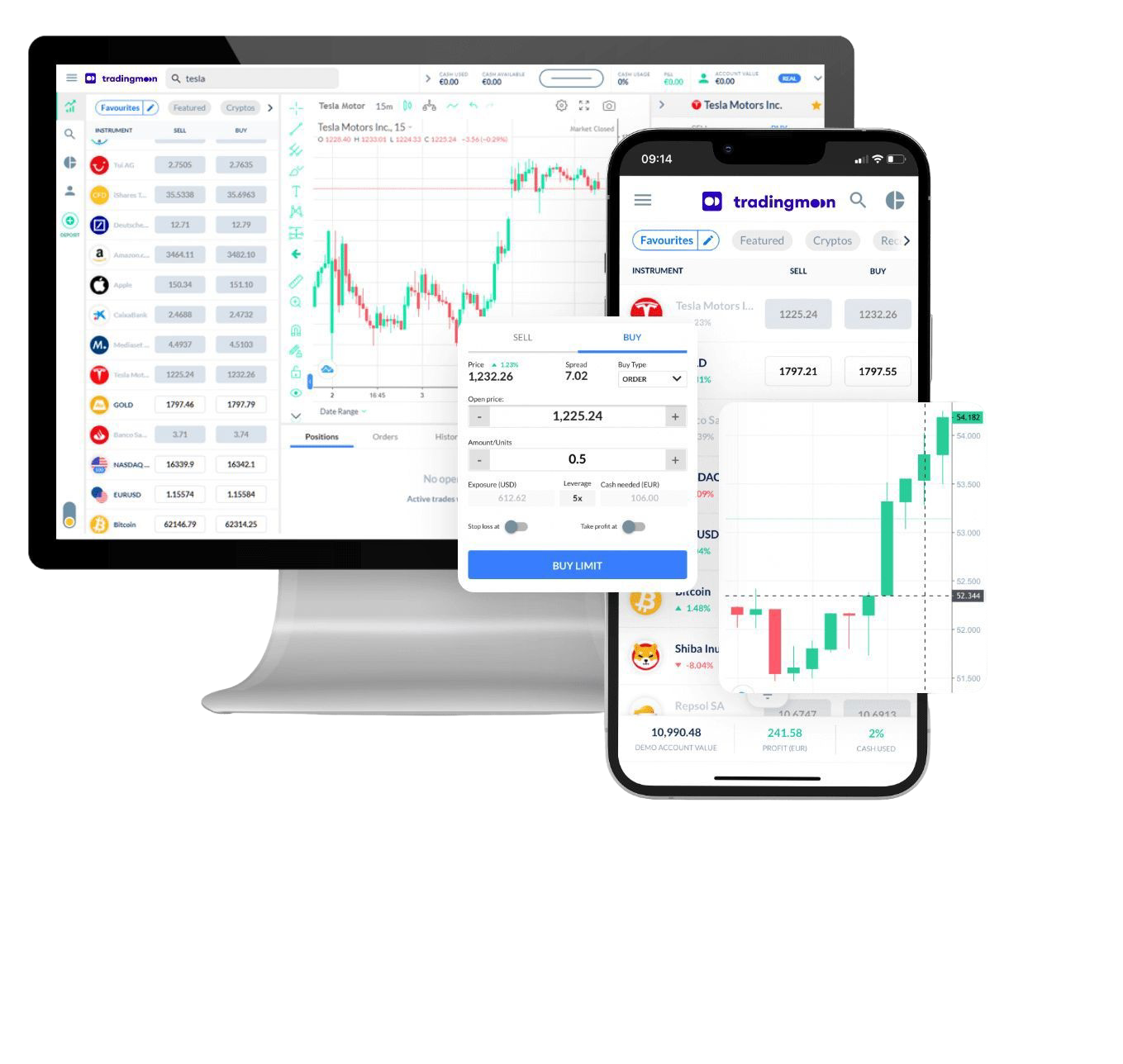

Trade Cotton with TradingMoon

Take a view on the commodity sector! Diversify with a single position.

- Trade 24/5

- Tight spreads

- Average Execution at 5ms

- Easy to use platform

FAQs

What affects Cotton prices?

+ -

The Civil War had a major impact on the price of cotton, as it was a major conflict fought over the rights of states to own or not own slaves and what could be done with them. This disruption in a production led to a drop in supply and an increase in demand, which consequently drove up prices.

The Great Depression also had an effect on cotton prices, as the decrease in economic activity and purchasing power meant that demand for cotton was much lower. This resulted in an oversupply of the commodity, leading to a significant drop in price.

Given these two historical events, it is clear to see how major events can significantly impact the global cotton market. As such, traders need to pay attention to current events and be aware of how they might affect the price of cotton. This could help them to make more informed decisions when trading this commodity.

How to trade Cotton CFD?

+ -

To start trading cotton CFDs, you will need to sign up with a broker that offers the instrument. Once you have an account, you will need to make sure it is funded with enough capital to cover your trading position.

Next, you will need to research cotton prices and decide which direction you think the market is headed in order to formulate your trading strategy. This could involve looking at fundamental data such as news and supply/demand factors, or technical analysis such as charting patterns.

Once your research is complete and you feel confident with your strategy, it's time to place a trade. You can choose to go long (buy) if you think the price of cotton will increase, or short (sell) if you think the price might decrease. After you have placed your trade, you can monitor it and close it out when you reach your desired profit or loss level.

What are the other options for trading Cotton?

+ -

If you're looking to invest in cotton, you have several options beyond just buying the raw commodity. You can invest in companies that produce and distribute cotton, such as Cotton Incorporated or Cargill, which are publicly traded stocks on major exchanges like the NYSE and US100.

Alternatively, you could also look into purchasing ETFs (Exchange Traded Funds) that track the cotton market or futures contracts for cotton. All these options offer a way to gain exposure to the cotton markets and potentially profit from price movements in the commodity. Ultimately, it's important to do research and understand all your choices when deciding how to invest in cotton.

Why Trade Cotton

Make the most of price fluctuations - no matter what direction the price swings and without the restrictions that come with owning the underlying asset.

CFD

Actual Commodities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Trade on volatility

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels