Adobe Stock (ADBE.US): Live Price Chart

Adobe Systems

ADBE.US

324.8005 13.054 (4.2%)

Low: 309.989

High: 326.795

About

About

History

Competitors

Adobe is a multinational software company based in San Jose, California. It was founded in 1982 by John Warnock and Charles Geschke. Today, from its US headquarters, Adobe creates a variety of products that are compatible with all digital devices, including PC, Mac, iPhone, and Android mobile devices.

Adobe specialises in multimedia content software. Its flagship products are Adobe Photoshop, an advanced image editing software, and Adobe Acrobat Reader, a program that allows users to view and manage another of Adobe’s products, PDF documents.

Other notable products from this tech company include Adobe Illustrator and the animation software Flash, which was acquired from Macromedia and later evolved into Adobe Flash. These products, as well as new innovations, are facilitated by a team of more than 26,000 employees in the US, India and other parts of the world. In 2021, Adobe's revenue was $15.78 billion.

| Swap long | -0.0799 points |

|---|---|

| Swap short | -0.0719 points |

| Spread min | 1.326 |

| Spread avg | 1.568 |

| Min contract size | 0.1 |

| Min step size | 0.1 |

| Commission and Swap | Commission and Swap |

| Leverage | Leverage |

| Trading Hours | Trading Hours |

* The spreads provided are a reflection of the time-weighted average. Though TradingMoon attempts to provide competitive spreads during all trading hours, clients should note that these may vary and are susceptible to underlying market conditions. The above is provided for indicative purposes only. Clients are advised to check important news announcements on our Economic Calendar, which may result in the widening of spreads, amongst other instances.

The above spreads are applicable under normal trading conditions. TradingMoon has the right to amend the above spreads according to market conditions as per the 'Terms and Conditions'.

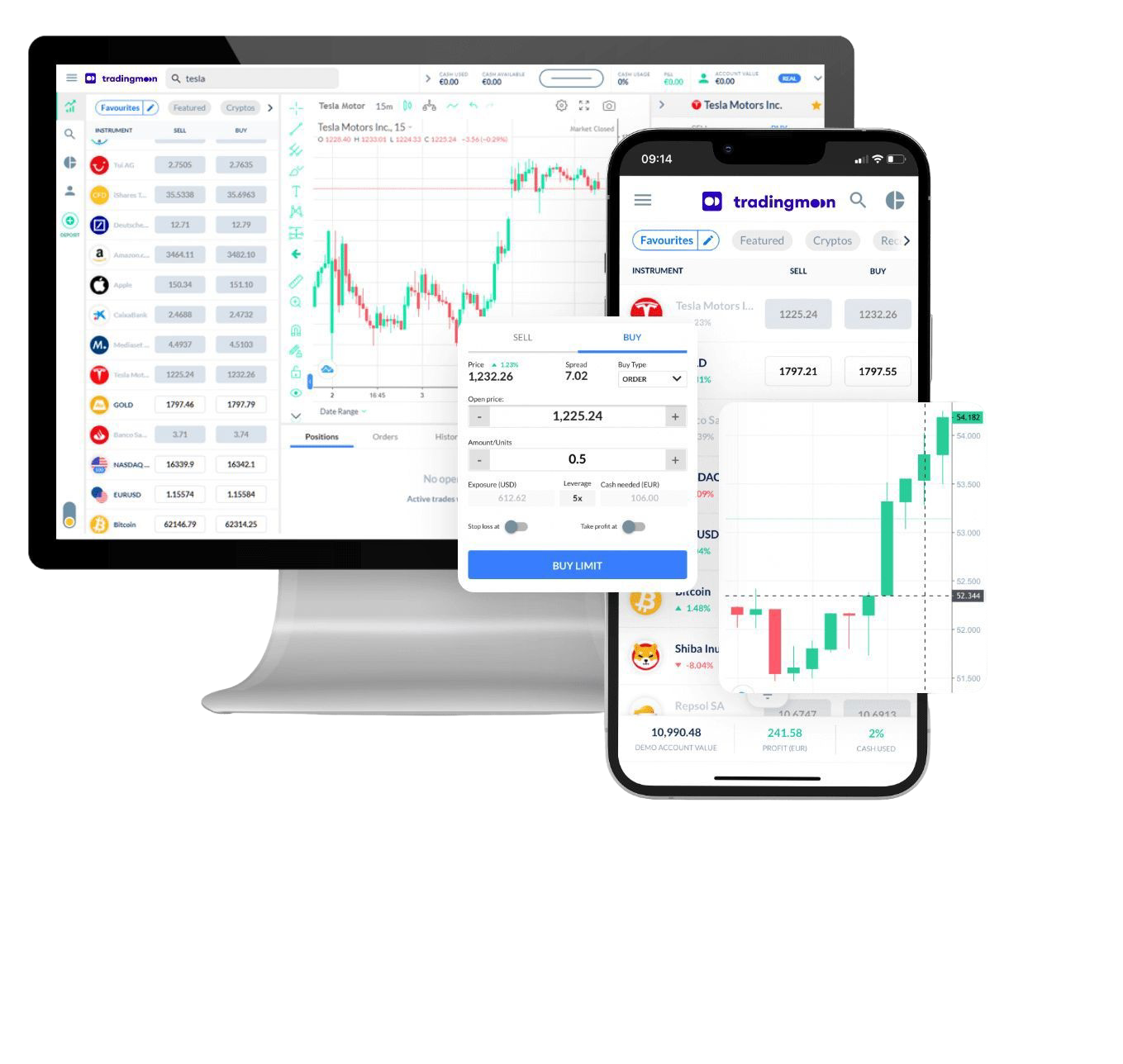

Trade Adobe Systems with TradingMoon

All Hassle-free, with flexible trade sizes and with zero commissions!*

- Trade 24/5

- Minimum margin requirements

- No commission, only spread

- Fractional shares available

- Easy to use platform

*Other fees may apply.

FAQs

What are the key drivers affecting Adobe's stock price?

+ -

Adobe's stock price is highly influenced by several external factors. These include the company's financial performance, market conditions, technological developments and competitive landscape. The company's financial performance is an important driver of its stock price, as investors look to assess the value of the company and its potential for growth.

Market conditions such as global economic trends and geopolitical developments can also affect Adobe's stock price. Technological developments and advancements, as well as the competitive landscape, are also important drivers of Adobe's stock price, as they indicate potential opportunities or risks to the company's performance. All of these factors combine to create a dynamic environment that can lead to significant changes in Adobe's stock price over time.

Who owns most Adobe shares?

+ -

Adobe is one of the most widely held public companies and is owned by more than 80% institutional shareholders. The largest individual shareholder of Adobe is Vanguard Group Inc, owning almost 40 million shares representing 8.59% of the company's total stock.

Other major institutional shareholders of Adobe include Blackrock Inc and State Street Corp, which together hold approximately 8% and 4% of the company's stock respectively. The remaining 18.7% of Adobe is owned by retail investors, making it a widely owned stock with many investors from both institutional and retail backgrounds.

Do Adobe shares pay dividends?

+ -

Adobe Inc. does not presently pay dividends to shareholders. However, they have historically had a high P/E ratio of 36.47, which suggests that the company may be reinvesting profits into its operations and growth opportunities rather than distributing them as dividends. Investors interested in receiving cash distributions from their Adobe investments should consider investing in other dividend paying stocks.

Competitors of Adobe such as Microsoft Corporation and Apple Inc. all pay dividends to their shareholders on a regular basis. It may be worth considering investing in these stocks for dividend income alongside an investment in Adobe stock.

Why Trade Adobe Systems

Make the most of price fluctuations - no matter what direction the price swings and without capital restrictions that come with buying the underlying asset.

CFDs

Equities

Capitalise on rising prices (go long)

Capitalise on falling prices (go short)

Trade with leverage

Hold larger positions than the cash you have at your disposal

Trade on volatility

No need to own the asset

No commissions

Just low spreads

Manage risk with in-platform tools

Ability to set take profit and stop loss levels